The importance of financial literacy hits particularly close to home for Michael Haddix Jr. As the son of former NFL running back Michael Haddix, he witnessed firsthand how professional athletes can struggle without proper financial guidance. The elder Haddix played eight seasons in the NFL with the Philadelphia Eagles and the Green Bay Packers but came from very humble—and, at times, tragic—beginnings. Orphaned at age 9 by a drunk driver on Christmas Eve, he was raised by his grandmother along with 11 other children. When those humble beginnings eventually led to fame and fortune, the Mississippi State Hall of Famer never forgot where he came from.

“When my dad became a pro athlete, everyone got taken care of,” Haddix Jr. recalls. “As his career wound down, he tried starting businesses. But he didn’t know how to do it the right way. One day, my dad got cut. My mother was crying on the couch. Our lives started changing after that.”

Building a better solution

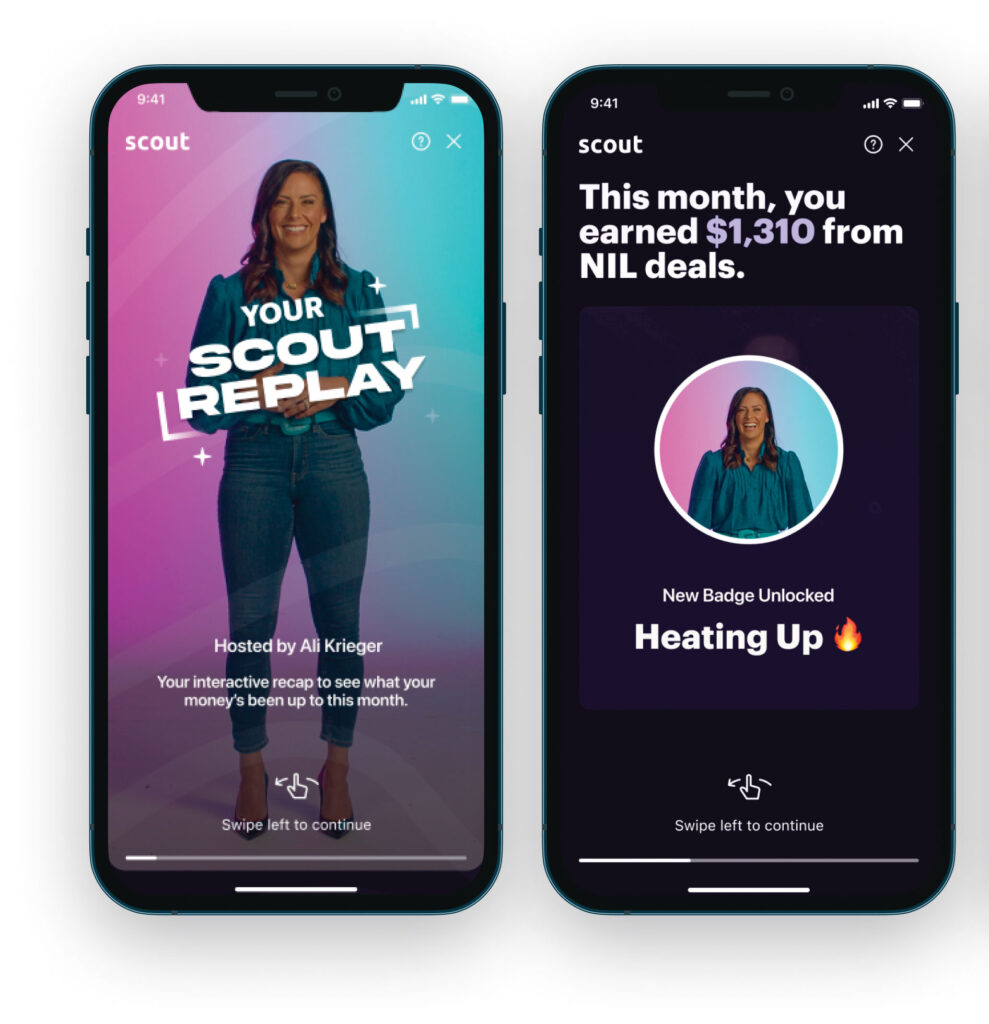

That experience became the catalyst for Scout, a fintech company Haddix Jr. co-founded in 2020 that combines financial education, wealth management and tax preparation specifically for college athletes. The platform comes at a crucial moment, as college athletes navigate the new frontier of NIL (name, image, likeness) deals and upcoming revenue sharing.

Haddix Jr. earned his MBA from Columbia Business School and worked as an investment banker at Goldman Sachs. An impressive athlete in his own right, he also scored over 1,000 career points playing basketball while attending Siena College. Before launching Scout, he worked as a financial adviser at Octagon, managing finances for sports superstars like Chris Paul, Steph Curry and Michael Phelps. But he wanted to make a larger impact.

“The biggest lesson from all of this is the sacrifice that you make benefits other people,” Haddix Jr. says, reflecting on his father’s journey. “I got into this because I think all these players, it’s not just about them. It’s about their families and their future kids and everybody around them.

“People [who] have money talk about money differently than people [who] don’t,” he continues. “I saw the opportunity and what it does for future generations. I was going to solve this athlete money thing. Then, I realized that ‘financial literacy’ is sort of this thing we say, but no one ever does. So I was like, let’s go build a tech platform to help this really unique subset of the population.”

Technology meets financial education

Scout’s platform does everything from calculating and withholding taxes to facilitating investments and savings. The company’s approach is already proving successful with major athletic programs and currently works with 12 athletic departments, including powerhouse franchises like UCLA, Tennessee and Auburn. Athletes receive on-campus financial training and year-round access to Scout’s mobile app, where they can design budgets, set up recurring bank deposits and make investments—all under the guidance of licensed financial advisers.

“You look at the schools that have invested in us and the success they’ve had,” Haddix Jr. says. “One of our early clients was Auburn basketball. They’re the No. 1 team in the country, and those players have been with Scout for years. You see the recruits of Auburn football and how successful they’ve been. You see the success of Tennessee. These schools are showing that the player experience off the field or off the court actually really does contribute to winning.”

The company’s approach is comprehensive, extending beyond just the athletes. “We provide education sessions for Mom and Dad,” he says. “A lot of times, they don’t know either. They’ve never seen a 1099. They’ve never made $700,000 as a 19-year-old.

“Everything is built for people who earn money until they’re 60,” Haddix Jr. says of existing financial tools. “This is completely tailored for young athletes in this unique financial situation they’re in.”

Beyond the game

Scout’s mission transcends immediate financial management. “Our mission is to provide the opportunity for every single athlete to leverage their current opportunity for the rest of their lives,” Haddix Jr. says. “Whether you go pro or don’t go pro, you have a ton of resources and opportunity. This current environment should benefit you forever.

“Trust is important to these players,” Haddix Jr. emphasizes. “A lot of people don’t get into their lives and their ecosystems. We need to make sure that we’re authentic and really focused on the mission and always keeping that in mind in every interaction that we have.”

His advice to college athletes is straightforward: “Getting started early will benefit you forever, and it doesn’t take a lot. All these things are really intimidating—how do I do taxes? How do I do an LLC? But it’s not that hard. The earlier you learn that, the easier it gets and just a few small things will equate to some huge opportunities down the line.”

Scout’s impact is already visible. Haddix Jr. says some professional athletes continue to use the platform, investing money monthly, well after they’ve moved on from college sports. Others who’ve transitioned to different careers continue benefiting from Scout’s financial education. For Haddix Jr., these proof points validate Scout’s approach to making financial health as important as mental health in college athletics.

Looking ahead, he sees potential to expand Scout’s model to other industries where traditional financial planning doesn’t quite fit—entertainers, influencers, even gig economy workers. But for now, his focus remains on athletes, ensuring they don’t face the same financial struggles his father did.

“We’ve seen athletes and money and how it hasn’t worked out for so long, and we haven’t really done anything to change it,” he reflects. “Let’s create something where we look back at this in 10 years and say, ‘Remember when we were treating athletes and money this way? How crazy were we?’”

This article originally appeared in the July/August 2025 issue of SUCCESS magazine. Photo Courtesy of Michael Haddix Jr.